A Complete Guide To Reverse-Engineering Strategy

Every product already has a strategy. Even yours. The question isn't whether you have one. It's about seeing what it actually is and making better choices.

Hey, Paweł here. Welcome to the free edition of The Product Compass.

It’s the #1 most actionable AI PM newsletter read by 121K+ AI PMs.

Here’s what you might have recently missed:

Consider subscribing or upgrading your account for the full experience:

Our guest today is strategy and OKR expert, Mike Goitein, author of the Product Strategy Decoded newsletter.

Michael has consulted in tech for over 20 years, with 8 years in strategy and branding, and product development. Recognized as a global strategy and OKR authority, Mike works with product managers at all levels to develop their strategic sense and design better strategies.

Spoiler: Your product strategy might be different from what you think or from what your company says.

Hey everyone, Mike Goitein here.

As the founder of "Product Strategy Decoded," I've spent years helping founders and product leaders uncover the gap between their stated and actual strategies.

Loom’s Strategy Arc

Did you know that Loom's official strategy in 2019 focused on developer productivity?

Their roadmap prioritized technical features like API improvements and IDE plugins to help engineers and QA collaborate more effectively.

But their qualitative and quantitative usage data were telling a different story.

Users were increasingly ignoring their integration and workflow features and instead using their video functionality to record quick async recap messages. Those messages began replacing the need to have meetings.

When remote work exploded in 2020, Loom's true strategy became clear as they emerged as the leading async communication platform.

Acquired for a Different Strategy

It may not have been surprising that Atlassian acquired Loom, as connected-work acquisitions have been a cornerstone of its growth strategy.

The surprise was that Atlassian acquired Loom not based on its original official strategy, but the revealed strategy, based overwhelmingly on user behavior.

It’s a pattern you’ll see everywhere when you use the right lens.

And this gets back to a fundamental truth about product strategy many teams are unaware of.

You Already Have A Strategy

Every product already has a strategy.

The question isn't whether you have one.

The question is whether you know what it actually is.

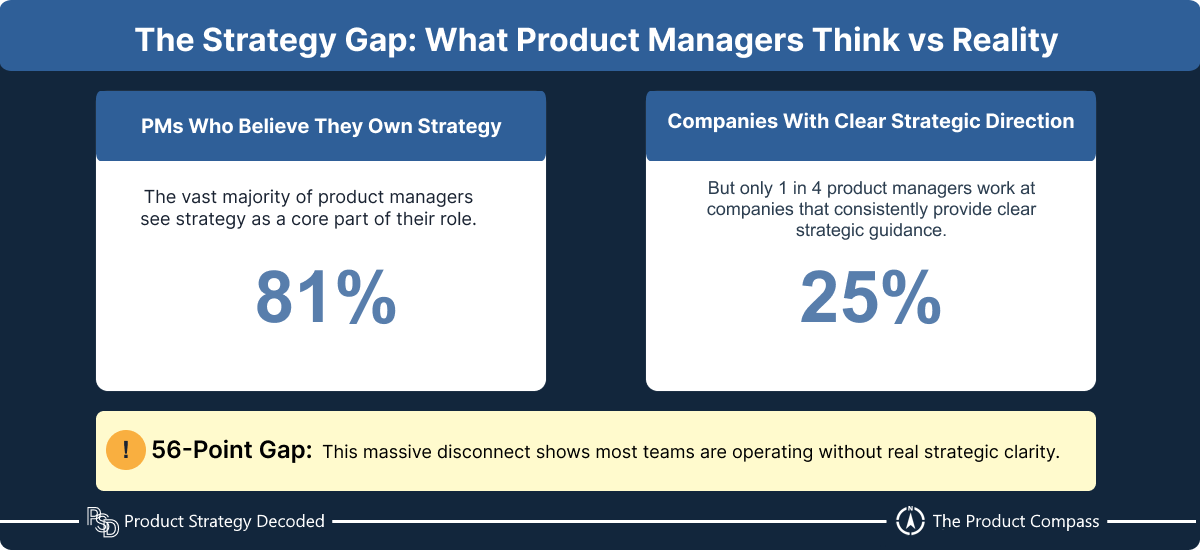

And this disconnect explains why 81% of product managers say they own strategy, yet only 25% work at companies that consistently provide clear strategic direction.

And this makes it more crucial than ever for product managers at all levels to improve their strategy skills, take ownership of the strategy component of their role, and provide missing strategic context. In doing so, they can ensure the choices they make are aligned with the market and the signals they’re getting from customers.

Seeing the Pattern

You can see examples everywhere:

How Discord pivoted from a gaming platform to a general community platform after discovering 78% of users weren't even gamers.

How Alma found the courage to transition from physical co-working spaces for therapists to transform into a virtual care platform after losing 70% of revenue in one COVID weekend.

And how dbt Labs transformed from a plateauing consultancy into a $4.2B SaaS company after realizing their internal tool was more valuable than their core business.

The shared thread across these pivots is how each company stopped focusing on their “Mission” and plans and started listening to actual user behavior and what their product was uniquely helping them achieve.

But we have no chance of recognizing these signals unless we bring a completely different approach to strategy than what most teams use.

What Really Is Strategy?

One quick definition here – the strategy approach I’m using is miles apart from legacy enterprise business and military approaches to strategy.

Designed and championed by Roger L. Martin, strategy is a problem-solving framework based on a creative set of choices you make to compel customer behavior in ways that mean success for them, as well as for your business.

It’s important to remember that because strategy deals with human behavior, an overly analytical and data-driven mindset won’t be as effective here. At best, we’re looking to probabilistically influence user behavior.

Just don’t get caught in the trap of believing you can deterministically get users to do what you want them to.

Decoding Product Strategy

As the founder of “Product Strategy Decoded,” I’ve spent years helping founders and product leaders understand the importance of strategy as a creative skill and working with them to identify gaps between stated and actual strategies.

I've seen teams waste months building features nobody uses while ignoring key patterns that, if followed, would have revealed a real competitive advantage.

So I'm here to give you a different lens into strategy that could give you the breakthrough you’ve been seeking.

From Ambiguity to Clarity

One product lead I worked with was receiving multiple, conflicting suggestions ranging from financial targets to goals, and specific features to build from leadership and stakeholders across their multinational organization.

We worked through the Strategy Choice Cascade, mapping publicly available information against their understanding.

In a couple of short sessions, we uncovered a set of choices leadership needed to make, as well as a breakthrough alternative set of strategic choices to guide their product roadmap into next year to better support the overarching global company strategy.

Your Step-By-Step Strategy Toolkit

That's why today, we’re going to dive into:

Why Leaders Fail at Strategy

The "Playing to Win" Strategy Framework and How to Reverse-Engineer It

The 4-Step Process to Reverse-Engineer Your Strategy

Strategy Reverse-Engineering: Practitioner Insights

Key Questions to Ask During Reverse-Engineering

Your Three Options After Reverse-Engineering

The Strategic Choice Cascade: Templates and Takeaways

Six Critical Questions You Need to Get A Strategy Reality Check

My Challenge to You: Take Back the Strategic Aspect of Your Product Role

But first, let's understand why most product teams have no idea what their actual strategy is.

1. Why Leaders Fail at Strategy

For better or worse, any strategic clarity (or lack thereof) comes from company and product leadership.

Yup, I said it.

And one of the biggest mistakes product managers make is waiting around for their boss or manager to tell them what their strategy is.

Product is The Strategic Role

While Product Managers have countless responsibilities, their most important role is simply this:

To bring higher-level organizational strategy to life through their product in ways that delight customers.

That’s it. They’re the ultimate interpreter of overarching organizational strategy, and primary designer of the product-level strategy that nests under and supports that higher-level set of choices.

Discovery can inform product-level choices, but they are ultimately in service of delivering against the company's single set of strategic choices – Customers, Markets, Channels, Offer, etc..

Because when the overarching strategic choices are unclear, upper-level leadership is responsible.

I’ve seen three reasons for this gap first-hand:

Reason #1: How they became managers

Here's the hard truth: many leaders got into their roles by being the opposite of what we normally think of as “strategic.”

They succeed by being the go-to “firefighter” in every crisis.

When something important catches on fire, the reliable firefighter pulls the best people and puts them on that “crisis du jour.”

So “saving the day” is what helps people get ahead.

In addition to that, many managers and leaders tend to learn strategy in business school, which has a heavy emphasis on “strategic planning,” where strategy becomes a budget with some “resource planning” sprinkled in.

So the people under them are constantly scrambling.

Reason #2: They confuse goals with strategy

How many times have you heard some leader say, "Our strategy is to increase MRR by 10%."

And everyone just nods their heads.

But that’s not a strategy. It's a goal.

Strategy tells you the choices you need to make for HOW you'll get there. Will you expand to new markets? Add premium tiers? Target different customers? The choices you make and the alternatives you intentionally reject are what define your strategy.

One dead giveaway for me that a team is working under a leader who isn’t great at strategy is to ask them: "What have you deliberately chosen NOT to do?"

If they can't answer, I know they’re working under a leader who's a bad strategist.

Reason #3: They confuse plans with strategy

Your product roadmap is not your strategy.

The roadmap says, "build this, then add on these features in this order."

But if you’re planning your roadmap before making choices, you’ll have no idea WHY these choices matter more than alternatives, or how they work together to create sustainable advantage.

The Best-Laid Plans…

Microsoft's Copilot provides a perfect example.

Microsoft had a plan to compete with Google in search, and so it originally positioned Copilot as "the new Bing." It was only after seeing how users were using it that Microsoft discovered that what users really wanted was an AI “companion,” not a “new way to search.”

And this is a testament to the “new” Microsoft under Satya Nadella.

Microsoft skillfully pivoted to rebrand Copilot as a connected AI companion, introduced tiered pricing, and created an entire AI platform ecosystem.

That's the difference between a skillful strategic pivot and a roadmap feature shuffle.

Leader Strategy Discovery

90% of the time, you have to treat your leaders and strategy the way you treat your users and features.

You can’t just ask them to tell you.

You want to be skillful in asking them the right questions to discover what your leaders’ hidden strategy actually is.

So if traditional strategy approaches fail, and leaders often can't articulate their real strategy, how do you actually figure out what's driving your product decisions?

The answer lies in a framework that’s miles apart from conventional strategy approaches.

2. The "Playing to Win" Strategy Framework and How to Reverse-Engineer It

After asking leadership, the next biggest mistake teams make is going to their “official” strategy PowerPoint document to see what it says.

90%+ of the time, all they’ll get is some flowery language that doesn’t help them make a single decision.

The right question to ask is:

"What do our actions and where we’re spending our time tell us about our real priorities?"

I’ve found Roger L. Martin’s “Strategy Choice Cascade” incredibly helpful as a lens through which to understand the true choices controlling what gets done.

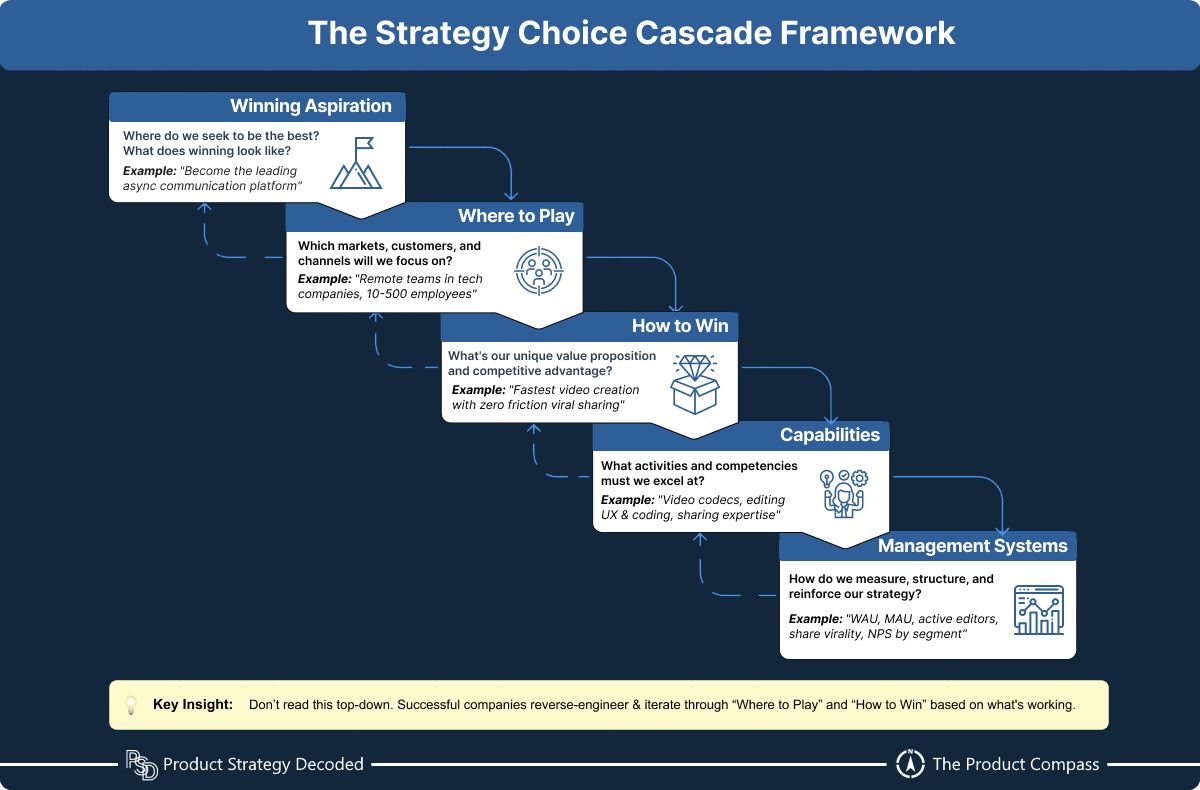

The Strategy Choice Cascade Framework

Made up of five questions, Martin’s “Playing to Win” strategy framework is an industry-leading gold standard for strategy design:

What is our Winning Aspiration? (Purpose)

Where Will We Play? (Market, customers, channels)

How Will We Win? (Value proposition, unique advantage)

What Capabilities must we have? (Activities, competencies)

What Management Systems are required? (Metrics, structures, processes)

Too many PMs start with building a brand new strategy pyramid from the top down, starting with their lofty mission statement at the peak.

The biggest problem? As I’ve written about previously here, locking in too early on your “Mission” and “Vision” can be one of the worst things for your product.

Paweł Huryn: Martin’s framework is compatible with our Product Strategy Canvas. The canvas was inspired primarily by Roger L. Martin’s insights. I grouped elements differently and adjusted the terms to what PMs are used to (e.g., Vision, Market Segments, Value Proposition).

Building a Case Through Strategic Clues

Instead, we want to think of it like being a private investigator.

We start by looking for clues and evidence across actual decisions and user behaviors that are there but hidden. We gradually look for a real underlying cohesive “motive” and a set of choices that tie them all together.

Because our “Winning Aspiration,” or the “motivation” for our strategy, grows over time from the successful combination of our other strategic choices.

Not because we “wish” and “hope” the lofty statements we’re making in our PowerPoints will magically come to life.

Case Study: Lattice's $100M lesson

Lattice started as an OKR platform. Their stated Mission was to "reinvent goal-setting."

But when they paid attention to their users’ needs and results, they (as many others) discovered that people increasingly saw OKRs as a "nice-to-have" rather than essential.

The proof? Poor retention after the first quarter, and low willingness to pay.

Co-founder Jack Altman explains:

"We had people paying us annual upfront contracts without ever touching a real product, just on our design mocks."

Lattice pivoted to comprehensive performance management and learned that:

"If you're working on something that isn't getting great traction, you're probably not a 10% adjustment away—you're probably a 200% adjustment away."

The Lattice team went back and made a different, better set of choices in line with what their users really needed from them.

That 200% adjustment is sometimes what it takes.

And that’s exactly the kind of insights reverse-engineering can reveal. It allows you to fundamentally reassess what business you're actually in and the choices you’re making.

3. The 4-Step Process to Reverse-Engineer Your Strategy

Let's talk about the gap between stated and revealed preferences.

As we saw with leadership above, and I wrote about here, human biases create massive disconnects between what users say they want or need (stated preferences) and what they actually do (revealed behavior patterns).

The same applies to your organization. There's often a gulf between:

What your strategy document says

What your leadership team thinks the strategy is

What your actual product decisions reveal

Start with observing what people do, not what they say.

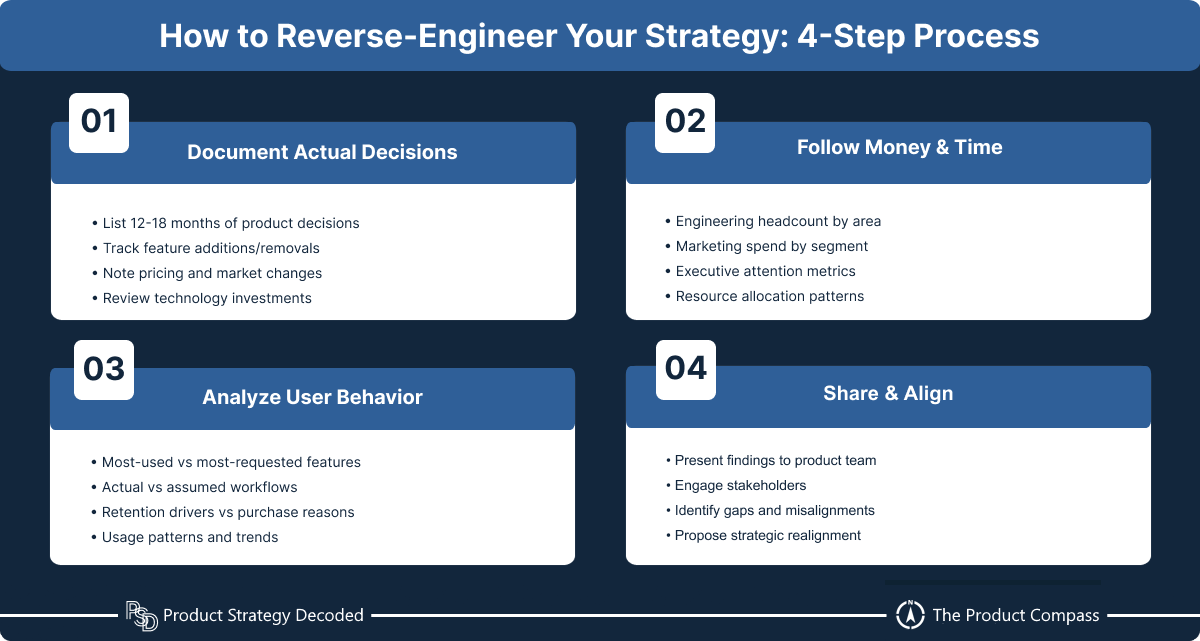

You’ll need to become a strategy detective to unearth the hidden choices controlling your product below the surface. Here’s a 4-step process I recommend:

Step 1: Document Actual Decisions

List every significant product decision from the past 12-18 months:

Feature additions and removals

Resource allocations

Pricing changes

Market expansions or contractions

Technology investments

Step 2: Follow the Money and Time

Look at where you've invested most of your resources:

Engineering headcount by product area

Marketing spend by segment

Executive attention (meeting time, emails, presentations)

Step 3: Analyze User Behavior

Capture what users actually do versus what they say:

Most-used features versus most-requested features

Actual usage patterns versus assumed workflows

Customer retention drivers versus stated purchase reasons

Step 4: Share & Get Buy-In

Share these insights with your Product Team and other product leaders

Share with stakeholders

Suggest ways to realign the “official” vs. “in-use” sets of choices

Case Study: Discord's Hidden Strategy

As I reverse-engineered here, Discord’s stated Mission under founder Jason Citron was to be “the gaming communication platform of choice.”

But Discord discovered that 78% of users were using the platform for non-gaming or mixed purposes by analyzing actual usage patterns.

This behavioral insight drove their expansion to become a general community platform, preparing for a 2025 IPO with $600M+ annual revenue.

The key, as we’re seeing, wasn't asking users what they wanted.

It was observing what they were already doing and responding.

4. Strategy Reverse-Engineering: Practitioner Insights

Now it’s time to roll up our sleeves and start practicing how to reverse-engineer so you can understand the real strategy controlling your product team’s choices.

But before you reverse-engineer your own company’s strategy, you’ll want to warm up and get a feel for the framework, and do this as a team.

Prerequisite: Learn How to Collaboratively Reverse-Engineer

As I do every week, reverse-engineering a successful company's strategy is like watching sports game film. It allows you to spot the patterns and choices that separate winners from wannabes, helping you and your team see what makes great product strategies work.

💡Practitioner Insight: Start by practicing on another product’s strategy. Get a cross-functional group together and pick a company you all admire and know well. Pull people from every level, including executives, middle managers, and front-line staff.

Time to get out your forensic researcher hat.

Swarm through these five questions like you're revealing the clues to how successful companies really think:

Winning Aspiration

What does this company claim to be the best at?

What's their vision of victory?

Where Do They Play?

Which markets and customers do they target?

Where do they choose NOT to compete?

How Do They Win?

What makes customers consistently choose them over competitors?

What's their unique advantage?

What Capabilities Do They Excel At?

What do they uniquely do well that others have a hard time matching?

What skills and activities power their competitive edge?

What Management Systems Do They Use?

How do they measure success?

What structures have they created, what systems keep them sharp, and allow them to continue improving their Capabilities?

Reverse-engineering is a journey. Don't worry about getting it perfect out of the gate. The key is starting and building your strategic muscle as a team. The patterns you spot here will sharpen your team’s ability to understand and better design your own winning choices.

Choose your champion and start decoding.

And have fun with it!

Case Study: Loom’s Strategy Reveal

Loom's strategic pivot came through a set of key insights:

They discovered 80% of power users were communicating with people they didn't share office space with

Users were creating video libraries for team onboarding and replacing written communication

COVID-19 validated the async communication trend

They shifted from "Video recording simplified" to "Async video messaging for work."

Making this shift wasn’t just “positioning.”

It was marketing and strategy combined in the purest sense and led to a different set of product choices: centralized video libraries, team collaboration features, enterprise security controls.

All these choices together led to Atlassian’s $975M Loom acquisition.

Advice on How to Best Reverse-Engineer

You've given your strategic muscles a workout with other companies.

Now, it’s time to shine that spotlight inward and decode your own organization's strategic DNA.

Now it’s time to peel back that set of good intentions, goals, plans, and some competing priorities that usually pass for strategy, and see what’s really going on under the covers.

My advice:

💡Seek out different perspectives: As you answer the five questions, pull in points of view beyond the same strategy and product leadership.

💡Work through all five questions: Answer each question. Go back and forth, and make sure you have answered the questions the best you can, the way things are being done, not as you wish they would be done.

If you stick through this and keep this as a simple, central document, for the first time, your team will see your real strategy laid out clearly. Not the one in your presentation deck. The one you're executing against, the one really controlling your choices.

💡Pro tip for facilitators: After seeing your company’s true choices laid out for the first time, it’s possible someone will say, “That's not our strategy.” Respond with: “Help us understand what evidence supports that.” This keeps the conversation grounded in observable behaviors instead of opinions and assumptions.

💡Handling disagreements: When team members disagree about a company's strategy choices, ask each person to cite specific evidence (product decisions, resource allocation, user behavior). The goal isn't consensus on interpretation, but agreement on facts."

💡Timeline expectations: Plan 3-4 hours for your first reverse-engineering session. Block 60-90 minutes for evidence gathering, 60-90 minutes for framework completion, and 60 minutes for discussion.

With this map in hand, you now have a foundation to build a strategy that is better-aligned with your customers’ and your organization’s broader needs.

But first, we’ll need to extract actionable insights from your reverse-engineering work.

Your cascade becomes truly valuable when you ask the right questions about what you've discovered.

Let's dive into the specific questions that will transform your cascade into a set of interconnected choices.

5. Key Questions to Ask During Reverse-Engineering

As I said in the past (later used by others), “The quality of your strategy depends on the quality of your questions.”

Accurate reverse-engineering depends entirely on asking the right questions.

Here’s a set of the most powerful questions I've found for each aspect of the Strategy Cascade:

For Winning Aspiration:

What outcomes do we celebrate internally?

Which metrics get the most attention in executive meetings?

What do we tell investors about our future?

For Where to Play:

Which customer segments really generate the most revenue?

Where are we actually allocating sales and marketing resources?

In which markets are most successful? Why?

Are there markets that we’re ignoring that we should be?

What channels are most effective for us?

Which offers are customers most responding to?

What are we strongest at? What is commoditized that we could offload to other suppliers or partners?

For How to Win:

What do customers actually cite as reasons for purchase?

Which competitive advantages consistently show up in head-to-head win/lose reviews?

It’s not just about one-off strengths - Ask what activities do we do together well that allow us to win?

For Required Capabilities:

Where do our best people get assigned?

How does this support our “Where to Play” and “How to Win” choices?

What skills are we hiring for or developing internally?

Which technical investments receive ongoing funding?

What capabilities do we consistently invest in?

Where are we looking to start investing more?

For Management Systems:

What actually gets measured and rewarded?

How are resources allocated in practice?

What behaviors get recognized and promoted?

Are we investing enough in our Management Systems?

Are people empowered to take action on what they learn from metrics?

What and how do we measure things differently, in ways that others don’t?

How does this support and help us improve our Capabilities?

Case Study: Microsoft’s AI Strategy Insight

Microsoft's AI strategy shift involved more than just rebranding Copilot from search to AI companion.

The revealing question was: "How are users actually using the technology to meet their needs differently from what we intended?"

While GitHub Copilot was intended for code completion, users discovered 10+ unexpected applications, including things like debugging workflows, auto-generated pull request summaries, terminal command help, and documentation generation.

These revealed both new opportunities and use cases, as well as introducing new areas of risk, as some engineers began developing "decision fatigue" and resistance from over-use and over-reliance.

The insight helped Microsoft broaden its AI strategy beyond single-use tools to comprehensive productivity workflow integrations.

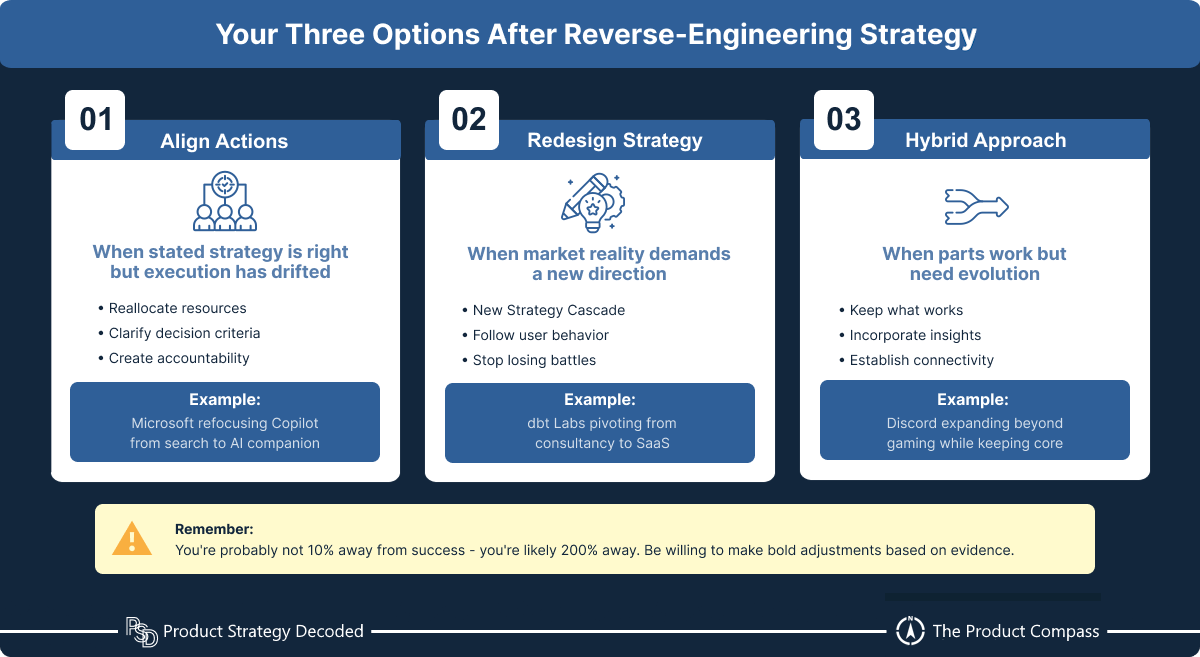

6. Your Three Options After Reverse-Engineering

Discovering your actual strategy is only valuable if you use it as a foundation for better choices.

There are three main ways you can apply what you and your team have learned through reverse-engineering:

Option 1: Align Actions with Stated Strategy

If your stated strategy still makes sense, but execution has drifted:

Reallocate resources to match strategic choices

Establish clearer alignment between decision criteria and choices

Create structures, metrics, and accountability mechanisms for strategic alignment

Option 2: Redesign Strategy Based on Evidence

If user behavior and market realities are telling you you need to go in a different direction:

Design a new set of choices across the Strategy Choice Cascade to match actual strengths and traction

Double down on the emerging opportunities your users reveal through qualitative, story-based discovery

Deliberately make the hard choice to stop trying to play where you're never going to win

Option 3: Hybrid Approach

Depending on your case, you may need a combination:

Keep elements of your current strategic choices that are working – Usually, this will be somewhere around your “Where to Play”

Incorporate new insights from user behavior and market feedback loops (like $$$)

Establish clearer connectivity between strategic choices and use them to guide priorities and plans

Case Study: The dbt Labs Transformation

The Fishtown Analytics consultancy team discovered their internal tool (dbt) was gaining 1,000+ users with 3X year-over-year growth while their consulting practice was stagnating..

Recognizing this signal, they made the strategic choice to transition to dbt Labs as a SaaS platform, leading to a $4.2B valuation and $100M+ ARR by 2024.

They moved from 3 engineers supporting 1,000 companies to a scaled platform serving the entire data engineering ecosystem.

The dbt Labs team’s key was the willingness to make that "200% adjustment" rather than just making tiny, incremental changes when the evidence showed the possibility as a viable option.

7. The Strategic Choice Cascade: Templates and Takeaways

As you run this process continuously and collaboratively, you’ll go beyond identifying strategic gaps and begin building better strategic decision-making habits.

To help you implement this methodology with your team:

The Strategy Detective's Workbench: Notion Template

I’ve been a huge Notion fan for years, even reverse-engineering its strategy here.

I've created a comprehensive Notion workspace that walks you through the entire reverse-engineering process.

This workspace gives your team a place to map patterns to the Strategy Cascade framework.

Copy it to your Notion instance for free here:

StrategyCascade.ai: Your Strategy Alignment Platform

For teams ready to take the next step in their strategy practice, check out my dedicated SaaS app at StrategyCascade.ai.

Going beyond static templated approaches, both product managers new to strategy and experienced strategists can quickly gain strategic clarity by stepping interactively through the five boxes of the Strategy Choice Cascade.

Frequently, people and teams get distracted by “shiny objects” during the strategy design process, and put goals or plans in the boxes. I’ve curated a targeted set of in-line questions and hints at each step to keep you on track, guiding you to design better sets of strategic choices. You can add, edit, and save multiple strategies in one central location.

The platform just entered beta, and I'm offering early access to readers of this newsletter.

Over time, we’ll be adding more ways to think through the cascade, ask the right questions at the right times, and test the logic of your choices to design better strategies.

8. Six Critical Questions You Need to Get A Strategy Reality Check

Wondering whether your organization needs this approach?

Key Questions to Reveal a Strategy Gap

Unless you’re in the rare group of outliers with experienced, strategic leadership, ask yourself:

Q1: The Alignment Test: Can your team consistently explain your strategy in the same way?

Q2: The Roadmap Test: Where did your fastest-growing features come from? On your original roadmap, or via customer feedback and behavior patterns?

Q3: The Resource Allocation Test: Are you disproportionately spending your time and money on things that don’t match your stated priorities? Timesheets and delivered features reveal priorities more accurately than slide decks.

Frame-Shifting Questions for Deeper Insights

If you’re stuck in your day-to-day and unable to get the necessary clarity or objectivity, ask yourself:

Q4: The Outsider's View: What would an objective observer say about your strategy based solely on your products, services, and market actions?

Q5: The Decision Pattern: Look for common threads connecting your last 10 significant product decisions. These patterns often reveal your unstated strategy.

Q6: The Investor Pitch Test: When explaining your success or failure to investors, would you proudly cite your strategic choices? Or would market conditions and competitor actions dominate your explanation?

The more uncomfortable these six questions make you, the more urgently you need to reverse-engineer your actual strategy.

9. My Challenge to You: Take Back the Strategic Aspect of Your Product Role

Strategy isn't just about building what you said you would.

It's about your entire approach to discovering what you should be building, based on what's actually happening in the market.

Or as Marty Cagan says, transforming in how you decide what problems to solve, and how you solve problems.

If there's one thread connecting Loom's pivot, Discord's expansion, dbt Labs' service to product transformation, and Microsoft's AI evolution, it's this: successful strategy design emerges from the interaction between your intentions, reality, and solving customer problems.

The companies that win aren't the ones with the “best” or “coolest” strategy docs. They're the ones that consistently ask the right questions and build systems to detect and respond to what's actually happening.

The Reverse-Engineering Challenge

No one is born a great strategist.

But anyone can learn and practice the skills required to design great strategic choices.

Reverse-engineering is the foundational product management and leadership competency that only increases in importance as you progress in your career, from Individual Contributor (IC) to manager, and beyond.

The question isn't whether your product or any other product has a strategy. The question is whether you can map it and crisply and consistently articulate it.

Every day, the gap between your hidden, stated, and actual strategies will widen, making it increasingly impossible to make informed product decisions.

You just want to make sure you get better at reverse-engineering before your competitors do.

Thanks for Reading The Product Compass Newsletter

Hey, Paweł here.

Exploring and learning together is great. But building?

That’s where the real growth happens.

I encourage you to review our step-by-step AI PM guides available in AI Product Management:

As a premium subscriber, you can also get my help anytime on Slack and join our weekly office hours.

Have a fantastic weekend and a great week ahead,

Paweł